Yes Bank – Why investors should exercise caution after the recent rally

Yes Bank continues to struggle on multiple fronts – weak deposit profile, sub-industry standard interest margin and continued elevated slippage despite complete clean up of the corporate book

Highlights

- Recent rally of close to 10 percent not guided by fundamentals

- Last quarterly number supported by fees and treasury gains

- Loan growth lagged the industry

- Deposits improving but quality warrants focus

- NIM contracts and headroom for further decline

- Reported NPA stable but slippage deserves close watch

- Journey to improving RoA arduous

- Stock expensive in the context of the tepid return ratios

The stock of

(CMP: Rs 18.4, Market Cap: Rs 52,913 crore) has rallied by close to 10 percent in the past few trading sessions and the rally wasn’t driven by fundamentals. In fact, the bank while jolly out of the crisis continues to struggle on multiple fronts – weak deposit profile, sub-industry standard interest margin and continued elevated slippage despite complete clean-up of the corporate book through the ARC transaction. The journey of RoA improvement, if at all would be a long-drawn exercise and in this context the current valuation appears expensive.

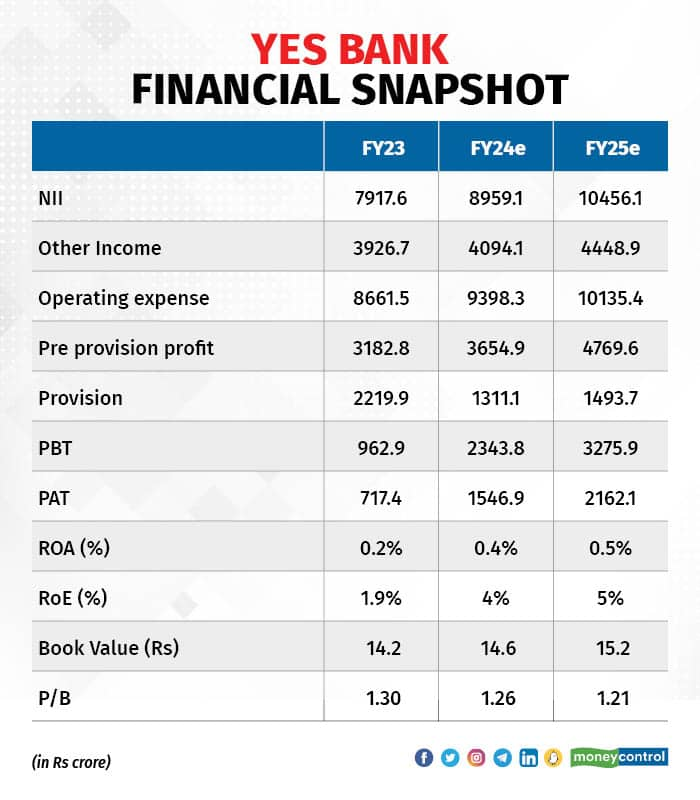

Yes Bank reported 39 percent rise in pre-provision profit in Q1 FY24 thanks to good growth in fees and handsome trading gains despite pedestrian rise in net interest income and substantial increase in costs. The reported net profit growth of 10 percent YoY was on account of steep YoY increase in provision.

Growth lags the industry

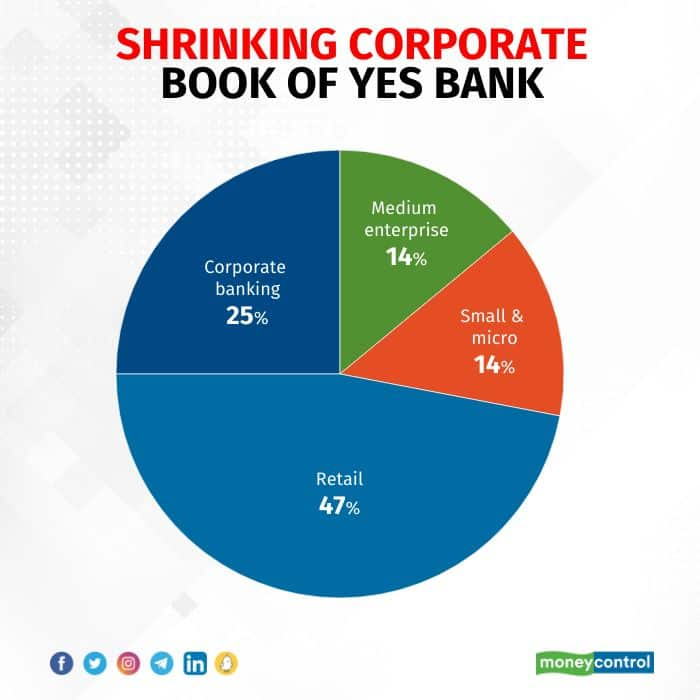

In the last reported quarter, Yes Bank reported advances growth of over 7 percent YoY and a marginal decline sequentially that was way below the system’s growth. The decline in the corporate book continues to be the culprit and is now down to 25 percent from 38 percent in the year-ago period.

Source: Company

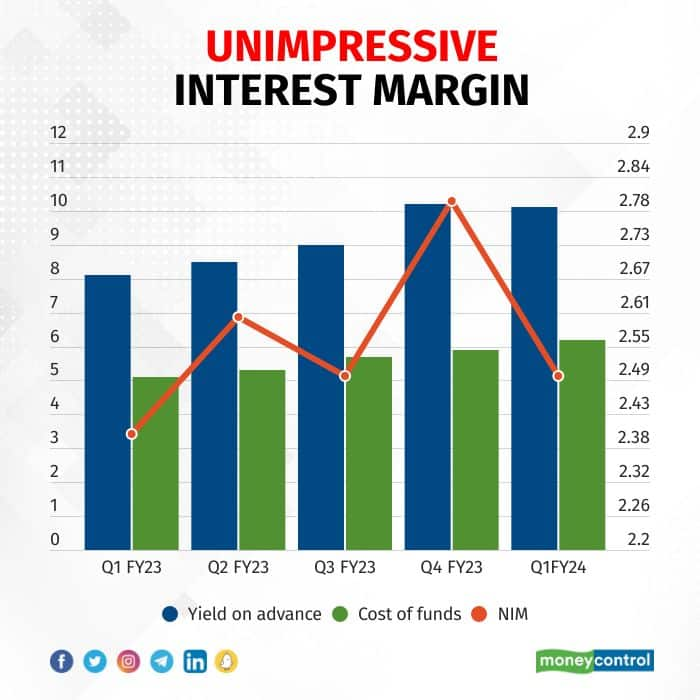

NIM contracts headroom for more decline

Despite the tilt in the book in favour of relatively higher yielding segments like retail and SME, the interest margin (NIM) remains at around 2.5 percent. In fact, in the last reported quarter, NIM declined sequentially by 10 basis points and given the possibility of close to 20 basis points increase in cost of deposits, there is room for further 5 to 10 basis points decline in margin. Unless the bank sees substantial improvement in deposit profile and/or lower slippage and interest reversal, margin uptick might prove challenging.

Source: Company

Liability – a lot of work left

The key to the success of any banking entity is the robustness of its liability that ensures healthy interest margin as well as good asset quality as it need not onboard excessively high yielding and hence high-risk lending to ensure superior margin. Yes Bank surely has a lot of work to do. While in the last reported quarter, overall YoY and sequential growth in deposits of 10.3 percent and 1.8 percent respectively was ahead of credit growth leading to a tad moderation in credit to deposit ratio to 91 percent (from 93 percent in March), the growth has been driven entirely by term deposits and low-cost CASA (current account and savings account) has de-grown and its share has fallen to 29 percent from 31 percent in the year-ago period. In fact, albeit the bank’s effort to garner more retail deposits the share of retail term deposits and CASA at 59 percent is much lower than peers.

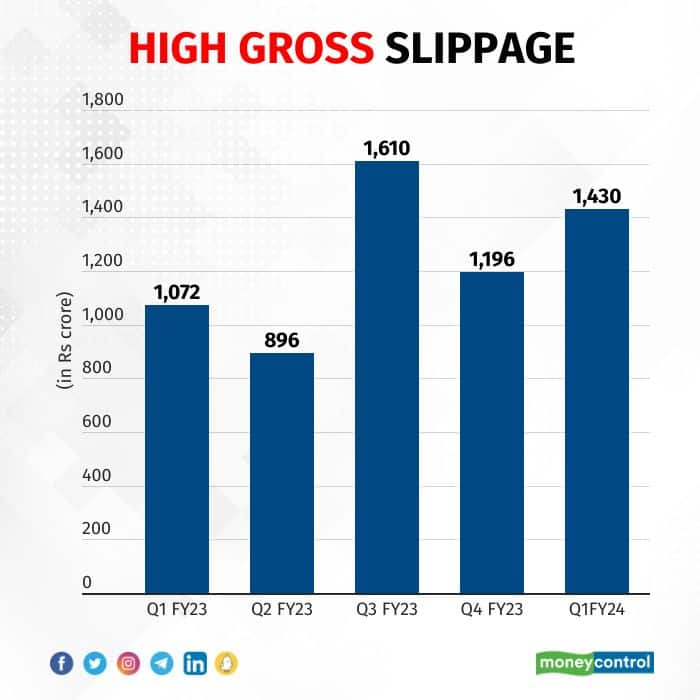

Asset quality – the pain is out but incremental slippage warrants monitoring

After the transfer of bad assets to ARC, the reported gross and net NPA have moderated to 2 percent and 1 percent respectively with a provision cover of 48 percent. However, what needs to be watched out is incremental gross slippage that continues to remain high at 2.8 percent and with a substantial portion coming from retail.

Source: Company

Thanks to the steep increase in operating expenses on account of people, products, technology and network and muted earnings performance, the cost to income ratio remained elevated at 74 percent and unless earnings pick up meaningfully, we do not see it moderating.

Improving RoA – a tall ask

The bank reported RoA of 0.4 percent in Q1 and has set a medium-term target of achieving 1 percent RoA. The bank expects the drivers to be loan growth and better yields, superior margin riding on improved CASA, step up in its own priority sector lending that will substitute PSL certificates which is a drag on margin, higher cross sell of products and reduction in credit cost to support RoA. We see the road ahead to achieve this to be much longer.

Seen in this context we perceive the valuation to be costly especially since a lot of banks with similar valuation are delivering a much superior ROA and Yes Bank’s road to full recovery is fraught with uncertainties.

Source: Company, Moneycontrol Research

.jpg)

.jpg)

.jpg)