www.ft.com /content/637b2a59-f64d-46b6-a8a8-0072e3a936d2

Robin Wigglesworth, Katie Martin and George Steer November 13 20216-7 minutes 11/13/2021

Analysts worry about ‘obvious signs of froth’ as everything from stocks to cryptocurrencies soar

Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

A “fear of missing out” has gripped global markets, lifting everything from stocks to cryptocurrencies to record highs and forcing even staunch bears to throw in the towel.

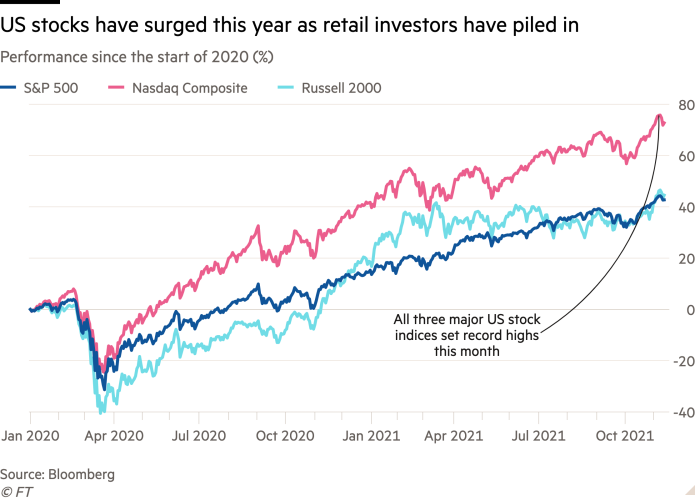

US equities are at the epicentre of the worldwide rush into stocks that has almost doubled the MSCI All-World share index since the coronavirus crisis nadir in March 2020 — one of the most powerful runs for global equities in history.

Wall Street’s S&P 500 this week sealed its longest streak of hitting record highs since 1964 before pulling back slightly, according to Bank of America. Meanwhile, highly-speculative digital assets such as bitcoin, ethereum and “meme coins” such as Shiba Inu have shot higher, bringing the crypto market value to about $3tn from less than $500bn at this time last year.

“The market has become a video game,” said Peter van Dooijeweert, a managing director at Man Group, the world’s largest listed hedge fund manager. “It feels like Candy Crush.”

Analysts and investors say an important driver of the rally has been the deluge of stimulus measures taken by global central banks to steady the world economy at the height of the pandemic last year and to ensure a powerful economic rebound.

This has left many low-risk assets such as high-grade government bonds offering scant returns and, in many cases, yields that are deeply negative when elevated global inflation is taken into account.

Analysts and investors say the market upswing has been supercharged by a boom in retail trading that began when many people faced severe social restrictions last year, but has continued even as economies reopen. And the signs of euphoria are multiplying.

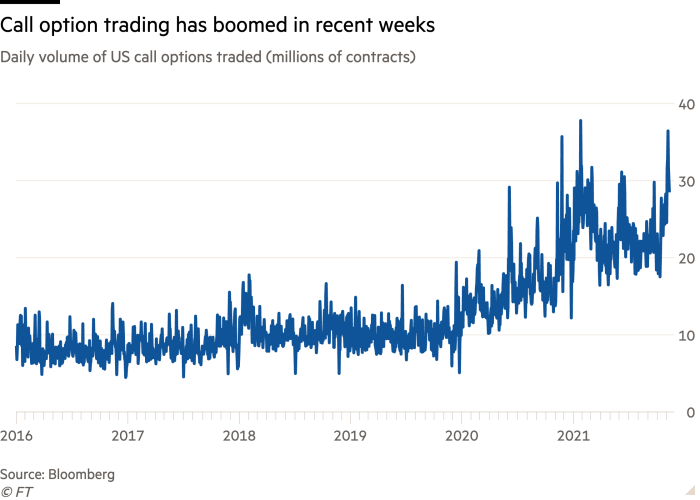

On November 5, a record $2.6tn worth of options — derivatives that allow investors to make magnified bets on or against stocks with borrowing — changed hands in the US, the highest trading volume on record, according to Goldman Sachs. Option trading volumes are now about 50 per cent more active in nominal dollar terms than all actual stock trading, the investment bank estimated.

Most of the options being traded are so-called “calls”, derivatives that allow investors to make aggressive bets that asset prices will rise. The overall trading volume of US calls is now back to the three-decade highs seen at the start of 2021, according to Nomura. That has pushed the ratio of calls to puts, which offer insurance against stock market downturns, to the lowest since June 2000, shortly before the dotcom bubble burst.

“There’s more volume in options than in actual equities. It has a huge impact on the market,” said a senior executive at one big trading firm. “Options are by their nature more speculative and leveraged. I don’t think this can go on for ever.”

Retail investors have been a major factor behind the surge in option trading, and a Nomura-Wolfe basket of US stocks popular with day traders has now gained about 150 per cent this year, compared with the S&P 500’s 24 per cent gain. “There are obvious signs of froth,” Raghuram Rajan, former governor of the Reserve Bank of India, said at a conference earlier this week.

Some analysts are also beginning to feel nervous. Charlie McElligott, an equity derivatives strategist at Nomura, said that he was feeling a little “yikes” watching markets at the moment. “It seems that ‘peak Fomo’ is permeating speculative assets,” he wrote to clients this week.

Highlighting how tough an environment this is for the dwindling band of bearish investors, Russell Clark of Russell Clark Investment Management finally threw in the towel this week, closing his eponymous London-based hedge fund after attempting to lean against the past decade’s market rally.

Globally, $865bn of new money has been pumped into equity funds this year, according to EPFR. That is already almost three times the previous full-year record, and more than two decades’ worth of combined inflows tallied by the fund flow data provider.

Some analysts say the rally could become even more ferocious in the coming month. McElligott pointed out that US corporate buybacks were about to resume after the enforced blackout when quarterly earnings are reported, and that fund inflows tended to be strong in the final stretch of the year.

Combined. these factors could push markets even higher into 2022, he argued. “It’s the playbook for a melt-up into year-end which I think folks are being ‘forced into playing’,” he wrote.

Barclays strategist Emmanuel Cau agrees that the market is more likely to swing higher than reverse course in the near term. “The market is running hot, yet fundamentals remain supportive of a further grind higher in equities,” he wrote. “Fomo prevails, but overall positioning is not stretched.”

Nonetheless, the frenzy is unsettling a lot of investors, who fret that what was a powerful but largely justified rebound from the shock of the coronavirus may now be verging into something more dangerous.

“Everything seems crazy, there are bubbles here, bubbles there, everywhere,” said Erik Knutzen, chief investment officer at Neuberger Berman. “It’s become a cliché, but we really are in uncharted waters, very unusual territory”.

No comments:

Post a Comment